The Extensive Self-help guide to Flipping Real Estate Property: Techniques, Obstacles, and Options

Introduction:

Flipping real estate property has obtained prevalent recognition as being a rewarding expense strategy, engaging both seasoned investors and newcomers likewise. The allure of purchasing distressed attributes, redesigning them, and offering for a substantial profit is indisputable. Nonetheless, profitable real estate turning requires not just a enthusiastic eyes for probable it needs a strategic technique, thorough preparation, plus a thorough understanding of industry dynamics. This complete information delves into the intricacies of flipping real estate property, exploring efficient strategies, prospective obstacles, and also the myriad options offered to brokers.

Comprehending Real Estate Turning:

Property flipping entails getting components, normally those in need of fix or renovation, increasing whole sale real estate them, and reselling them with a better value. The objective is always to acquire a fast turnaround and capitalize on the increased home worth publish-restoration. As opposed to acquire-and-keep strategies, which give attention to long term respect and rental revenue, turning is concentrated on quick-term results and quick deal periods.

The Turning Method:

Choosing the best Residence: Productive turning begins with identifying the right property. Buyers often focus on distressed attributes, foreclosures, or properties requiring considerable fixes. Key resources include real estate online auctions, lender-owned components (REOs), and distressed retailer item listings.

Conducting Research: Comprehensive homework is very important. This requires examining the property's issue, estimating restoration and restoration costs, and inspecting comparable sales (comps) in the region to ascertain property wholesaling the possible reselling importance. Comprehending local market place tendencies and desire is additionally vital.

Acquiring Funding: Financing a turn can be accomplished through numerous means, which includes personalized financial savings, challenging dollars personal loans, private loan providers, or classic mortgage loans. Tough cash loans, even though more expensive, are well-liked due to their versatility and faster authorization functions.

Renovating the house: Renovation may be the center of the turning process. Traders should center on inexpensive improvements that significantly improve the property's importance. This might include bathroom and kitchen remodels, floor coverings updates, fresh painting, and curb appeal enhancements. Handling renovation timelines and budgets is essential to capitalizing on profits.

Advertising and marketing and Promoting: Once refurbishments are full, your property is listed on the market. Powerful advertising and marketing methods, which include skilled photography, staging, and listing on several programs, are very important to draw in prospective buyers. Partnering with a qualified realtor can assist in quicker income and better negotiation results.

Great things about Turning Real Estate Property:

Substantial Profit Potential: Flipping real estate property can yield large earnings within a relatively simple time period, especially in trading markets with soaring property principles and demand.

Hands-On Investment: In contrast to unaggressive investment tactics, flipping will allow traders to actively participate along the way, from house variety to reconstruction and transaction, providing a sense of handle and success.

Marketplace Adaptability: Flipping enables traders to quickly adapt to marketplace problems, taking advantage of short-word tendencies and prospects that may not position with long-term expense techniques.

Ability Improvement: Flipping hones various capabilities, which include house evaluation, project management, negotiation, and market place evaluation, which can be useful for broader real estate property committing.

Problems of Flipping Real Estate Property:

Marketplace Volatility: Real-estate market segments might be volatile, and unexpected downturns can influence reselling benefit and success. Remaining informed about market place styles and monetary signals is important to minimize risks.

Restoration Risks: Unforeseen problems during remodeling, like architectural problems or computer code violations, can cause budget overruns and project delays. Thorough property assessments and contingency preparing are crucial.

Loans Expenses: Great-interest levels on difficult money personal loans and other quick-word funding possibilities can eat into profits in case the residence does not sell swiftly. Effective economic management and cost control are imperative.

Legal and Regulatory Agreement: Flipping properties calls for adherence to varied local, state, and federal government restrictions, which include constructing rules, zoning laws and regulations, and permit demands. Failure to abide can lead to fines and lawful issues.

Strategies for Successful Flipping:

Complete Researching The Market: In-range market research will be the reasons for successful turning. Knowing local marketplace dynamics, home values, and customer preferences assists establish rewarding possibilities and prevent overpaying for components.

Exact Price Estimation: Precisely estimating remodelling expenses and possible reselling value is vital. Utilizing knowledgeable installers and making use of detailed venture programs might help management fees and prevent finances overruns.

Efficient Task Managing: Successful venture management ensures refurbishments are accomplished by the due date and within price range. Normal improvement keeping track of, crystal clear interaction with contractors, and flexibility in dealing with issues are very important parts.

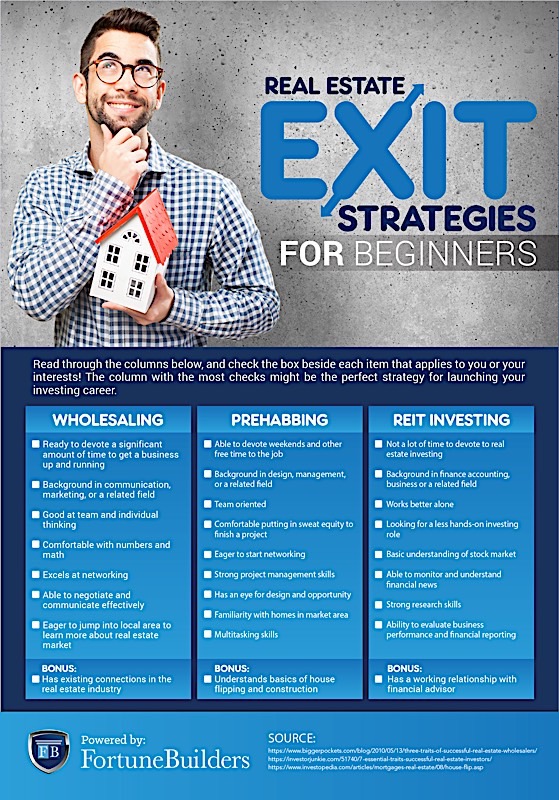

Get out of Approach Preparing: Using a very clear exit strategy, no matter if selling the house quickly or booking it all out if the industry circumstances are undesirable, provides a basic safety internet and ensures mobility in responding to industry modifications.

Networking and Partnerships: Developing a group of dependable building contractors, real estate professionals, lenders, as well as other pros can provide valuable assets, help, and prospects for partnership.

Options in actual Real estate Flipping:

Growing Marketplaces: Determining and making an investment in growing trading markets with powerful development possible can result in considerable revenue. These market segments often times have reduced admittance costs and higher respect rates.

Distressed Qualities: Distressed components, such as foreclosures and brief revenue, can be found at substantial savings, delivering sufficient space for profit after refurbishments.

Luxury Flips: Great-end properties in affluent communities can yield significant profits, though they require larger sized money assets along with a keen knowledge of high end industry styles.

Natural Refurbishments: Incorporating lasting and energy-successful capabilities in makeovers can interest environmentally aware consumers and potentially be eligible for income tax incentives or discounts.

Technologies Incorporation: Leveraging modern technology, like virtual organized tours, online marketing, and project managing application, can increase effectiveness, attract technical-knowledgeable buyers, and simplify the flipping method.

Summary:

Turning real-estate offers a engaging path for investors trying to find quick returns and lively involvement within the house market place. Whilst the opportunity of great profits is considerable, it arrives with its talk about of obstacles and dangers. Achievement in turning needs a proper technique, meticulous preparation, plus a deep knowledge of industry dynamics. By doing in depth research, managing makeovers properly, and staying adjustable to showcase conditions, buyers can browse through the intricacies of flipping and capitalize on the opportunities it presents. Regardless of whether you're an experienced buyer or possibly a newcomer to the real estate community, turning offers a powerful and fulfilling pathway to financial development and investment success.